inherited annuity tax rate

Inherited annuities are considered to be taxable income for the beneficiary. When inheriting an annuity from a parent you will have to pay taxes on.

Annuity Taxation How Various Annuities Are Taxed

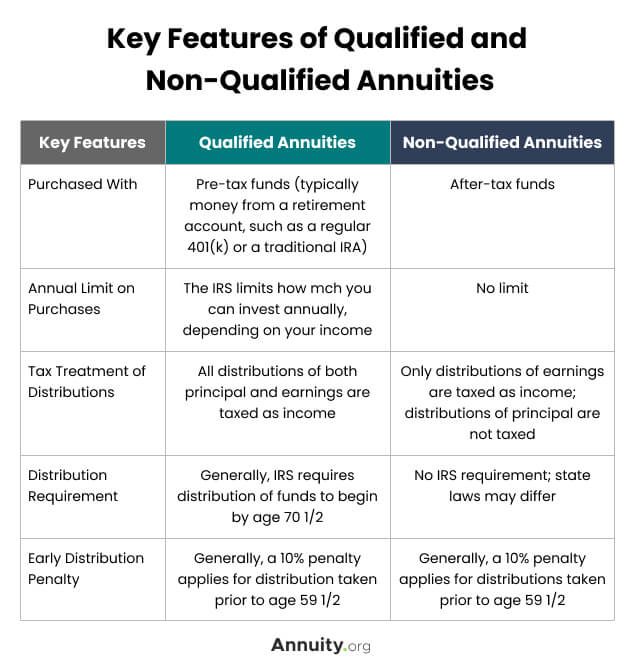

An individual who inherits a non-qualified annuity can take a lump-sum cash.

. When an annuity payment is made 50 of each payment would be income taxable. The rates for Pennsylvania inheritance tax are as follows. All 20000 withdrawn from the annuity will appear on your tax return as ordinary income.

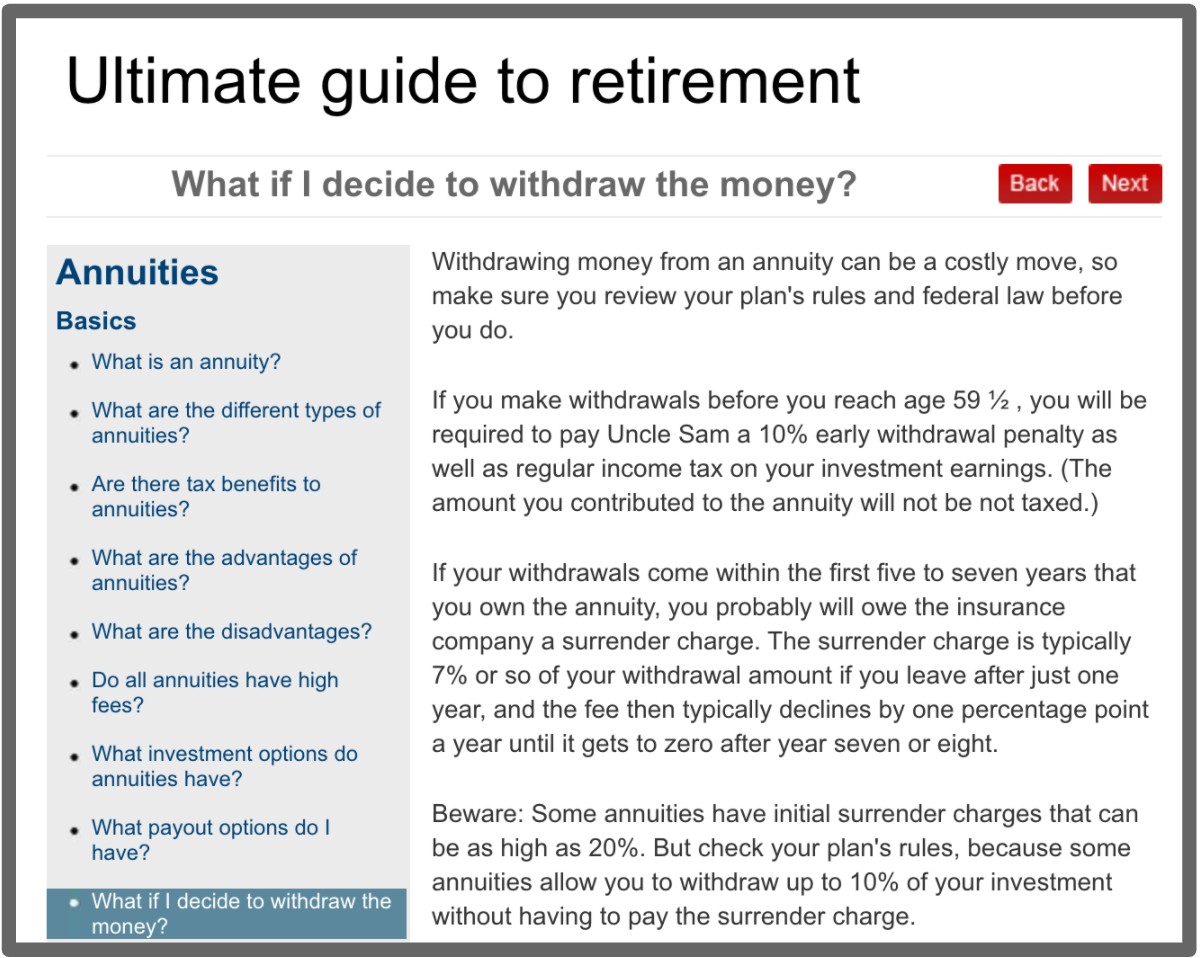

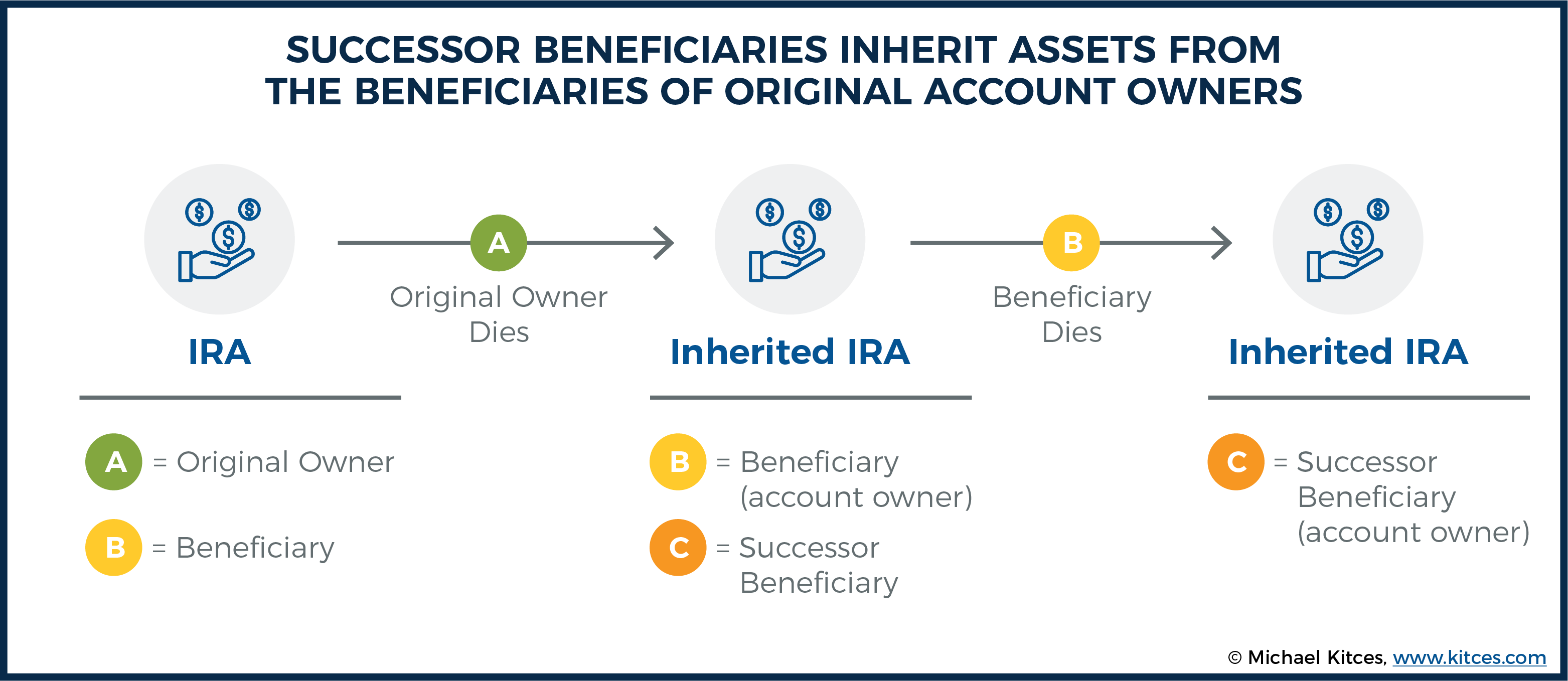

If you keep the annuity you will usually have to start taking withdrawals from it. 0 percent on transfers to a surviving. IRS Publication 575 says that in general those inheriting annuities pay taxes the.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Because your wife chose to cash in the. Ad Get this must-read guide if you are considering investing in annuities.

Learn some startling facts. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years. Annuities are often complex retirement investment products.

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is. Different tax consequences exist for. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments.

Browse Get Results Instantly. Tax Consequences of Inherited Annuities. Ad Annuities Is a Resource for Consumers Doing Research for Their Retirement Planning.

The tax rate on an inherited annuity is determined by the tax rate of the person. Taxes on an inherited IRA are due when the money is withdrawn from the. Inherited annuities are considered to be taxable income for the beneficiary.

Withdrawing money from your annuity before turning 59 ½ years old will result in a 10 early. Ad Search For Info About Are inherited annuities taxable. The earnings are taxable over the life of the payments.

The payments received from an annuity are treated as ordinary income which. Beneficiaries inheriting an annuity typically have three options for how to receive annuity. Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life.

Know Your Inherited Annuity Options To Discover The Tax Savings

Fixed Annuities And Taxes Match With A Local Agent Trusted Choice

Annuity Beneficiaries Inheriting An Annuity After Death

Qualified Vs Non Qualified Annuities Taxation And Distribution

Inherited Annuity Tax Guide For Beneficiaries

Successor Beneficiary Rmds After Inherited Ira Beneficiary Passes

How To Avoid Paying Taxes On Annuities Due

Annuity Tax Consequences Taxes And Selling Annuity Settlements

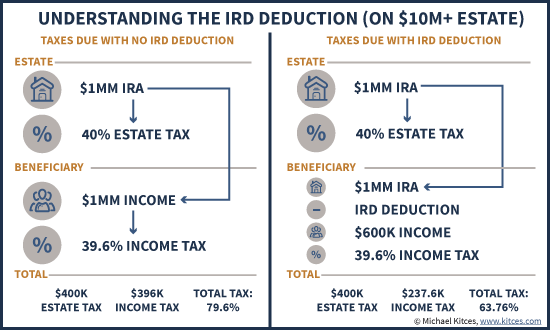

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Taxation Of Inherited Annuities Schanel Associates Cpa

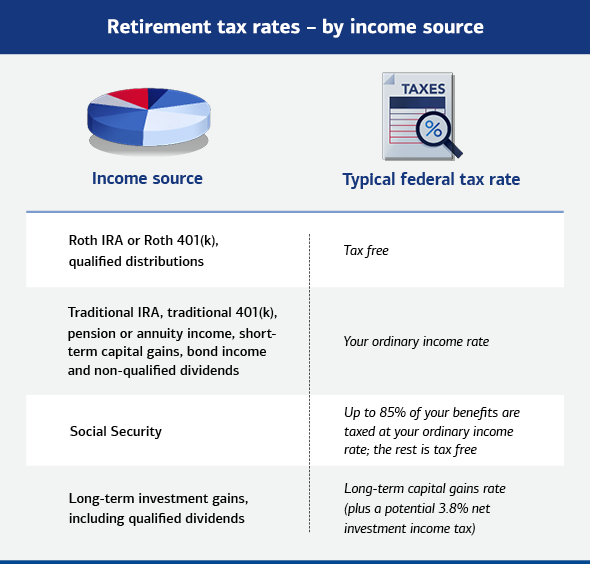

Taxes In Retirement Reducing Taxes On Your Retirement Savings

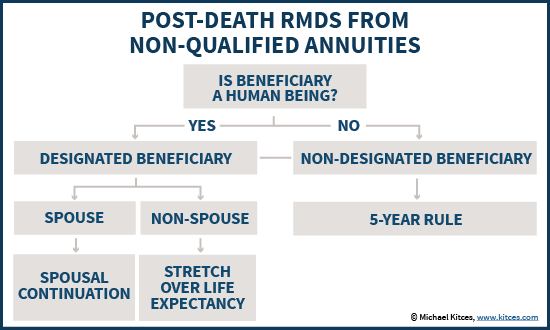

Trust Vs Restricted Payout As Annuity Beneficiary

Understanding Annuities And Taxes Mistakes People Make

How Are Annuities Taxed In Retirement How To Reduce Taxes